Dear Friends and Neighbors:

Together, we recently celebrated the City’s 14th Birthday at Samson Oceanfront Park and the grand opening of Heritage Park. The birthday celebration and the grand opening of the Heritage Park were joyous events where residents enjoyed the annual Offshore Power Boat Challenge at Samson Park and music, games, and splash fountains at Heritage Park.

The City Commission is extremely grateful for your support. With your continued support, we have accomplished so much in 14 years, and we are working on the final steps to complete the City’s green initiative, which spearheaded the development of numerous parks in the City. Again, I take this opportunity on behalf of the City Commission to provide you with this annual progress report to inform residents of the status of certain projects and initiatives.

Fiscal Stability

Unlike certain local governments in Miami-Dade County, the City has operated within its means during this tough economic period. The City Commission has made a genuine effort over the years to spend your tax dollars wisely. We have exercised fiscal discipline in managing the City’s affairs. We have invested your tax dollars in capital projects to enhance the market value of your home and to create amenities for residents. The City’s fiscal discipline is evidenced by the fact that the City maintains a healthy rainy day fund of ten million dollars to maintain the operations of the City in case of emergencies.

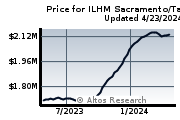

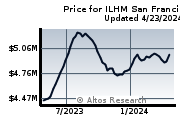

Additionally, this year we were thrilled to find out from Miami-Dade County that the City was one of ten municipalities that had an increase in property values. Property values in the City increased by 8.3% from the previous year. The increase in property values were due to numerous factors but we can point to our green initiative and infrastructure improvements as factors in keeping property values on the rise. As a consequence of increased property values, the City will be able to keep its tax rate steady and unchanged. The City has one of the lowest tax rates in Miami-Dade County.

Heritage Park

The construction of Heritage Park has been completed! On Saturday, June 18, we celebrated the opening of this beautiful park, which is located on 192 Street and Collins Avenue. The park has several amenities such as walking paths, separate playgrounds for toddlers and young children, a water fountain “splash play” area, a basketball court under the Lehman Causeway, and a dog park. One of the focal points of this park is the magnificent stage and the great lawn. Another notable feature of this park is the “Heritage Wall,” which is divided into two sections. One side honors Sunny Isles Beach residents who have served in the armed forces and the other side honors those residents who have been elected to serve the City since its inception as members of the City Commission. Residents, who do not live within walking distance from the park, can find sufficient public parking in the garage adjacent to the park. The parking is metered parking. However, residents will be able to buy yearly parking passes to park in the garage.

Gateway Park on Sunny Isles Boulevard

The City is now the owner of four (4) acres of land on the north side of Sunny Isles Boulevard. The purchase of the 4 acres was part of the green initiative to create neighborhood parks throughout the City. On June 15, 2011, the City Commission approved a ground lease and design/build agreement to form a private/public partnership with a major developer to build a first class park with upscale restaurants as amenities. The park will also contain a public parking garage for use by the public and customers of the restaurants.

The construction of Gateway Park will be the City’s tenth park, and the first major park on the south end of the City. The completion of Gateway Park will ensure every neighborhood of the City is only a short walking distance to a park. The City has agreed to pay ten million dollars for the design and construction of the park. The developer has agreed to pay all costs associated with the design and construction of the retail restaurants that will be located at the park. The developer will operate all aspects dealing with the retail restaurants and the City is entitled to receive 30% of the annual gross rental from any monies paid to the developer by tenants of the restaurants. All revenues collected from the garage will go directly to the City. This project is expected to commence in June 2012 and should be completed in early 2013.

The Intracoastal Parks on Collins Avenue

The City now owns three (3) properties in the southern part of the City on Collins Avenue, south of Sunny Isles Boulevard. The City is planning to construct pedestrian friendly passive parks on these properties. One of the three buildings has been demolished and the City is planning to create a passive park in that area no later than fall of 2011. We intend to demolish the remaining buildings in early 2012 to permit the construction of passive parks in these areas no later than summer 2012. The parks will provide an open view of the Intracoastal waters with adjacent walking paths.

Golden Shores Park

During the past year we doubled the size of the Golden Shores Neighborhood Park with the purchase of an adjacent parcel of land. We have completely redeveloped this park with new playground equipment and landscaping.

Bella Vista Bay Park

We are currently moving forward with a renovation plan for Bella Vista Bay Park, located under the Sunny Isles Boulevard Bridge, as a canoe/kayak drop off station with other amenities. The renovation will be completed fall of 2011.

Reconstruction of the Historic Newport Pier

The City has received the permits to reconstruct the historic Newport Pier located at Pier Park. Construction will commence later this summer. It is our hope that the pier will allow residents to enjoy the beach through fishing and scenic walks during sunrise and sunset. In addition, the pier will include a restaurant. We hope to see you at the grand reopening of the pier next summer!

Collins Avenue Beautification Project

The drive south from the Lehman Causeway introduces residents and visitors to the initial point of the Collins Avenue beautification project. Residents are greeted by lush tropical landscaping, an artificial pond, and decorative sidewalks upon driving south from the Lehman Causeway. This nearly complete project is scheduled for completion in 2012.

Atlantic Isle Neighborhood Improvements

Several years ago, the City installed a new drainage system with new streets in the Golden Shores neighborhood. Similarly, the City installed a new drainage system with new streets and a sewer system in the Atlantic Isle neighborhood. This project is in its final stage.

Scholarships for High School Residents

The City Commission has made a commitment to provide educational opportunities to our young residents. Last year, the City Commission approved a college scholarship program for high school students who graduate from a high school in Miami-Dade County. The scholarship recipients were selected by a committee composed of Police Chief Fred Maas and the principals from the Sunny Isles Beach K-8 Community School and the Alonzo and Tracy Mourning High School. Four students were each awarded $5,000 scholarships. They were Kathy Fernandez, Edgar Alza, Melissa Bouganim, and Zachary Berger. In addition, four students were awarded $500.00 scholarships. They were Amy Branigan, Kelly Wall, Hector Castaneda, and Maria Aza. Congratulations again to these students.

Tribute to our Hometown Heroes

As indicated previously, we had an opportunity to recognize our local military heroes and former and current elected officials at the grand opening of Heritage Park by listing their names on the Heritage Wall. We also recently recognized two former Commissioners, who played pivotal roles in the success of the City, Gerry Goodman and Roslyn Brezin, by naming 182nd Drive (adjacent to the school) after Commissioner Goodman and 183rd Street at Collins Avenue after Commissioner Brezin. Their love and dedication to the City are unmatched.

As a point of personal privilege, I was recently surprised to learn that Miami-Dade County School Board had voted to rename our K-8 school the Norman S. Edelcup Sunny Isles Beach K-8 School. This honor was granted to me based on my contributions in support of creating the first public school in the City. It is important to note this honor is shared with so many individuals who worked tirelessly with me in creating our magnificent school.

Cultural Programs

The City offers a myriad of cultural programs to our young children, families and active adults. The City will continue to offer these programs, which include the popular Sunny Serenade, family movie nights and Golden Era movie series, and classical music series featuring well known international musicians. The City has worked with Miami-Dade County Library Services to provide additional cultural programs to our residents.

Jazz Fest

The City will host its 4th Annual Jazz Fest Concert Series on October 14-16, 2011. The concerts will feature well known jazz musicians. A nominal fee will be charged for the concerts. We look forward to seeing you at the jazz concert. This year the Saturday night concert will be held in Heritage Park.

I hope you find this progress report to be informative. Should you have any questions or concerns, please feel free to contact me or any member of the City Commission. Our doors are always open.

Norman S. Edelcup, Mayor

If you spend a weekend creating a financial plan for your home now, it could save you money in the long run. Image: Veer

If you spend a weekend creating a financial plan for your home now, it could save you money in the long run. Image: Veer